Marginal tax rate formula

9515 Ignore any cents. Refer to the section Payments for ETPs at the end of this article.

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Business and organisations Ngā pakihi me ngā whakahaere.

. The third column indicates the tax rate itself. In G5 the first VLOOKUP is configured to retrieve the cumulative tax at the marginal rate with these inputs. Given that Congress has prescribed a system of progressive taxation all but the lowest-earning taxpayers pay distinct rates for different parts of their income.

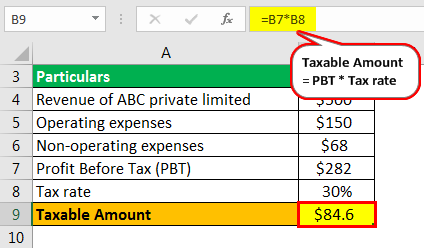

Of Units Consumed ΔQ Marginal Utility TU f TU i Q f Q i Relevance and Use of Marginal Utility Formula. Calculate the PAYG on the employees normal gross earnings of 116599 240. When considering a marginal tax rate versus an effective tax rate bear in mind that the marginal tax rate refers to the highest tax bracket into which a persons or companys income falls.

The amount of income that falls into a given bracket is taxed at the corresponding rate for that bracket. Many taxpayers therefore pay several different rates. Employing staff Te tuku mahi ki ngā kaimahi.

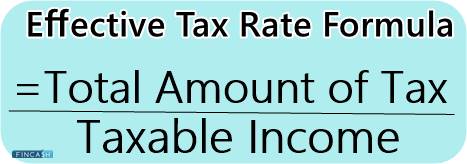

Cost of Equity Formula. Weighted Marginal Cost of Capital Proportion of Source 1 x After-Tax Cost of Source 1 Proportion of Source 2 x After-Tax Cost of Source 2. Your effective tax rate is also calculated like an average tax.

IRD numbers Ngā tau. As taxable income increases income is taxed over more tax brackets. Please note any other payout deemed to be ETP will not be used in the formula detailed in the next steps.

Using the steps in the ATOs Marginal Rate Calculation. Then your new marginal tax rate will be 26. KiwiSaver for employers Te KiwiSaver mō ngā kaituku mahi.

A public limited automobile company manufactured 348748 units of vehicles includes MHCV LCV Utility Therefore Marginal cost 57312 which means the marginal cost of increasing the output by one unit is. Marginal Utility Change in Total Utility ΔTU Change in No. Goods and services tax GST Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha.

Proportion of Source x After. While your federal average tax rate is 171 your federal marginal tax rate is 205. Read more are bifurcated into seven brackets based on their taxable income.

The weighted marginal cost of capital formula It is calculated in case the new funds are raised from more than one source and it is calculated as below. Marginal Tax Rate US. Below is an example reconciling Apples effective tax rate to the marginal rate in 2016 notice the marginal tax rate was 35 as this report was before the tax reform of 2017 that changed corporate tax rates to 21.

Marginal utility is an important economic concept that is based on the law of diminishing marginal returns. In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. Marginal cost 2 which means the marginal cost of increasing the output by one unit is 2.

You will remain in this marginal tax rate until your taxable income exceeds 98040 but remains lower than 151978. This formula determines a single tax rate. In the example shown the tax brackets and rates are for single filers in the United States for the 2019 tax year.

Marginal Cost Formula Example No 2. Lookup value is inc G4 Lookup table is rates B5D11 Column. The following are the IRS rate schedules for.

Income tax Tāke moni whiwhi mō ngā pakihi. The fourth column gives the range of income to which the current marginal rate applies. To calculate tax based in a progressive system where income is taxed across multiple brackets at different rates.

Marginal Tax Rate Bogleheads

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Effective Tax Rate Formula And Calculation Example

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Tax Rate Formula And Calculation Example

Marginal Tax Rate Formula Definition Investinganswers

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Marginal And Average Tax Rates Example Calculation Youtube

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

Income Tax Formula Excel University

What Is Marginal Tax Rate Insurance Noon

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Chapter 01 Learning Objective 1 2 Marginal Average Tax Rates And Simple Tax Formula Youtube

Definition Of Effective Tax Rate Fincash

Taxation Calculations Ppt Video Online Download

Effective Tax Rate Formula Calculator Excel Template

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition